Recovery of trade partners determines the growth of Finnish economy

Economic Forecast for 2020–2022

A loose fiscal stance costs less than long-run unemployment

The reduction of the Finnish GDP in the second quarter was smaller than expected. However, the recovery from the crisis will be slower than it was hoped for. We forecast that the GDP shrinks during the current year by 5.0 per cent. During the next two years, there will be a gradual recovery, whose strength depends essentially on the recovery of Finland’s export destinations.

The corona crisis will cause permanent changes to the structure of the Finnish economy. The shift to teleworking, which has increased exceptionally much in Finland, will partly be permanent. Also several policy measures motivated by the crisis, including Next Generation EU recovery instrument, will promote a shift towards digitalization and a greener economy.

The great Finnish depression in the early 1990s caused a massive surge in unemployment, and long-run unemployment remained on an unprecedented level when the Finnish economy was already growing rapidly. This was not just due to structural changes in the labour market, but also partly due to hysteresis effects which can be avoided by deficit spending. Unlike in the 1990s, the interest rates for Finnish sovereign bonds are now close to zero, and a loose fiscal stance costs less than long-run unemployment.

The current crisis will cause permanent changes also to the EU. The funding of Next Generation EU recovery instrument is based on a new model, which is in many ways analogous with Eurobonds, and the new funding model might be used also in the future. Perhaps more importantly, due to the activation of an escape clause, the adjustment path regulations of the EU economic governance framework are currently not being applied. After the crisis the number of EU countries whose EDP debt ratios are essentially larger than the maximum of 60 per cent will be much larger than before, which gives more weight to many criticisms of EU economic governance. The situation is unpredictable, since a return to the current framework seems hardly possible, but it is also difficult to see how EU countries could agree on reforming it.

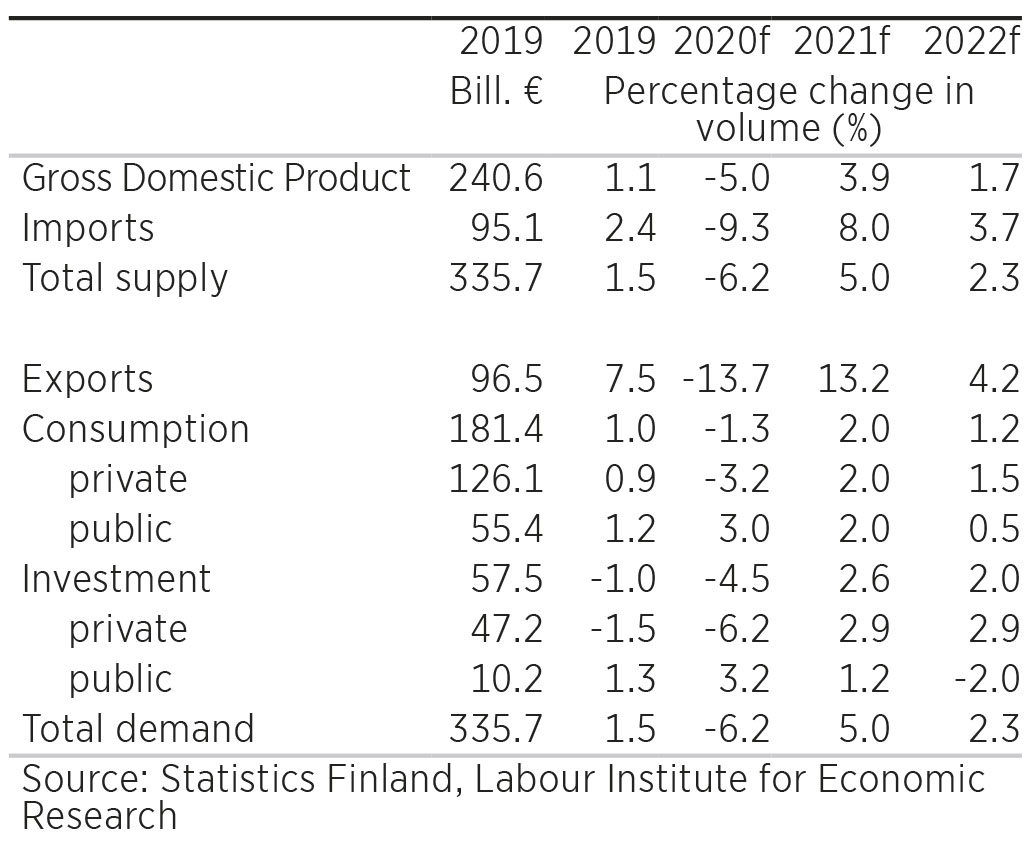

Demand and Supply

Economic Forecast for 2020–2022

Recovery of foreign trade as trade partners recover

We expect that the second wave of the corona epidemic will in many countries be considerably milder than the first one and that an effective vaccine for coronavirus will become available in early 2021. The world economy will suffer a deep contraction this year, followed in 2021 by a strong recovery which to a smaller extent continues in 2022. This scenario is faced by most developed countries, whereas China will enjoy positive growth already this year, and India and Latin America are experiencing greater difficulties.

In Finland the contraction of foreign trade was mostly due to decreased exports and imports of services. We do not expect dramatic changes to the situation during the current year. In our forecast scenario, there will be a rapid increase of both exports and imports in 2021 as Finland’s trade partners recover.

A moderate recovery of consumption and investments

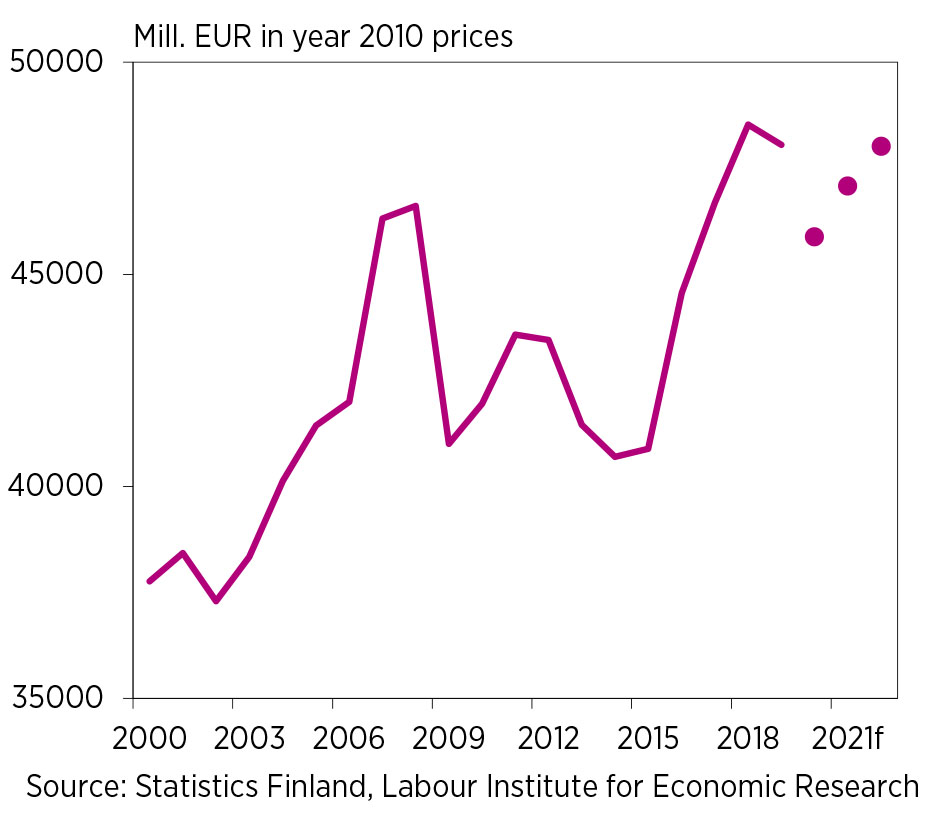

Investments are forecasted to decrease this year due to the corona crisis. Construction investments have suppressed the downfall of total investment in the first two quartiles. However, investments in machinery have dropped clearly in the first half of this year. Overall, investments are forecasted to decrease 4.5 per cent this year. In 2021-2 investments are forecasted to grow again by 2.6 per cent and by 2 per cent.

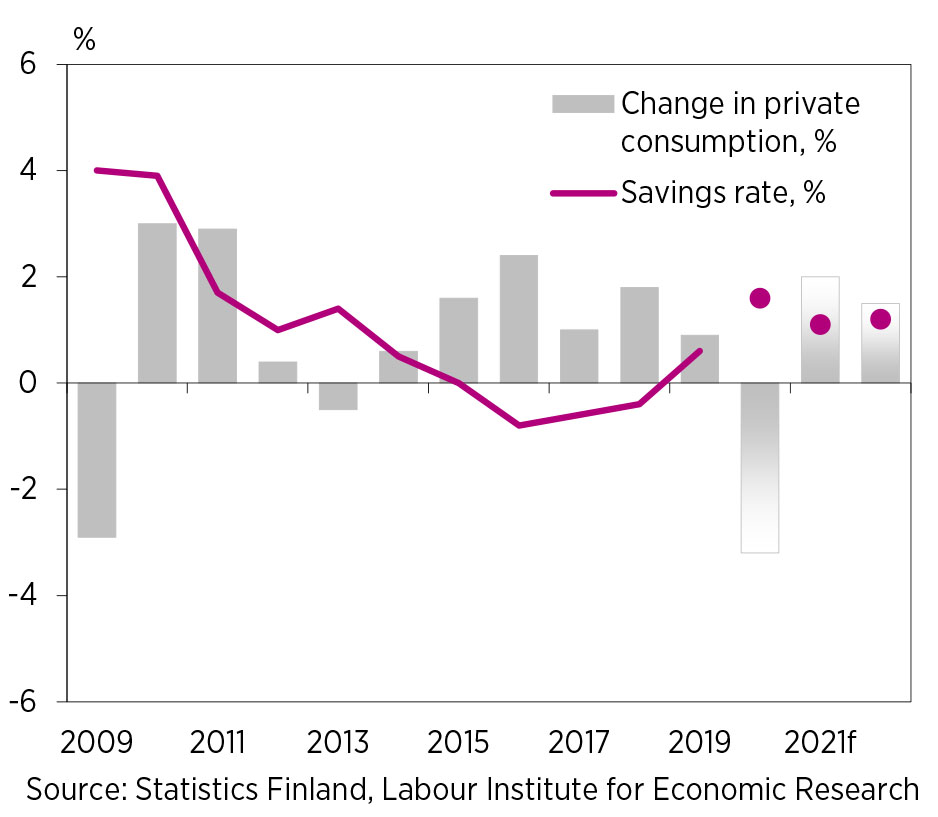

Private consumption recovered fast from the plunge caused by the pandemic in the second quarter of 2020 and is forecasted to fall by 3.2 per cent in 2020. In the future, economic uncertainty dampens private consumption, which we forecast to grow by 2 per cent in 2021 and by 1.5 per cent in 2022. Consumer price inflation falls to 0.6 per cent in 2020 but speeds up in 2021-2 as the economy recovers from the crisis.

The corona crisis has not led to the feared massive increase of unemployment. In our forecast, fiscal policy will also in the coming years to a considerable extent milden the effects of the crisis on the labor market. However, the corona crisis will cause considerable structural changes in the labor market.

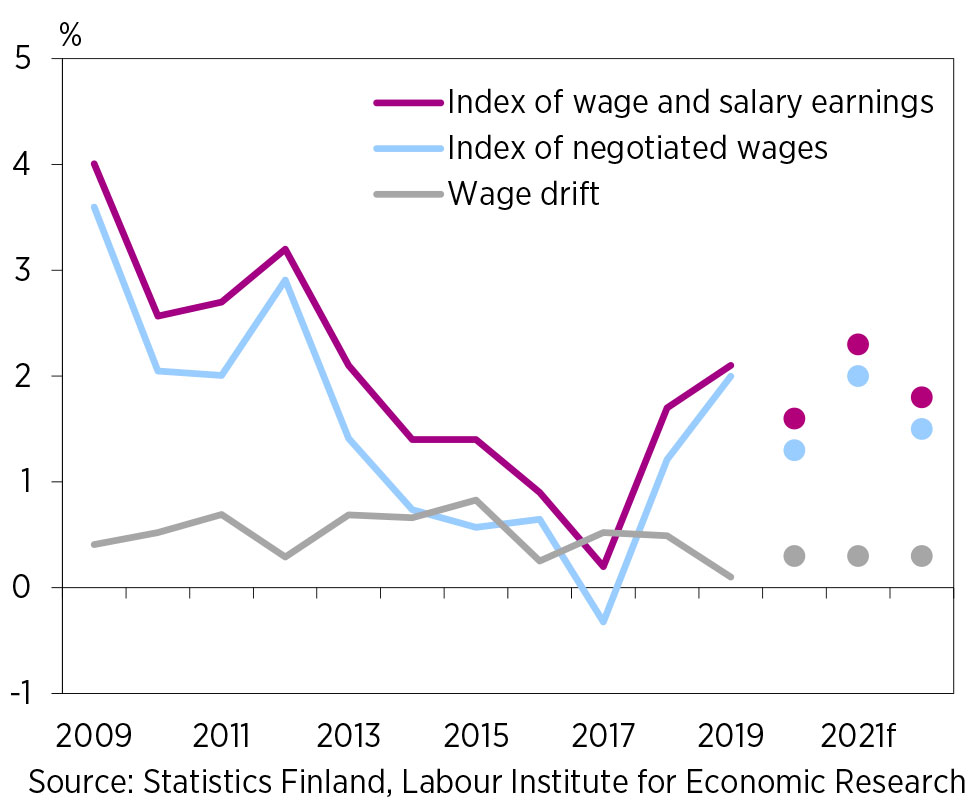

Also wage and salary growth remains moderate. The effects of the crisis on the cost competitiveness of the Finnish economy are still difficult to predict.

The EDP debt ratio increases rapidly this year, and it will remain above 66 per during 2020–2022. This is mostly due to the increase of debt on the state rather than on the local level since the state government has increased its financial support to the local governments.

Index of Wage and Salary Earnings and Index of Negotiated Wages 2009-2022

Economic Forecast for 2020–2022

Private Consumption and Savings Rate 2009-2022

Economic Forecast for 2020–2022

Investments 2000-2022

Economic Forecast for 2020–2022

Additional Information

Chief of forecasting

Ilkka Kiema

- Ilkka Kiema

- Research Leader

- Tel. +358-40 940 2287

- ilkka.kiema@labore.fi

- Profile