Still Waiting for the Post-Crisis Boom – Stronger Growth Extends Over Two Years

Economic Forecast for 2021–2023

The Labour Institute for Economic Research forecasts a growth rate of 2.5 percent for this year and 3.1 percent for 2022. The growth will slow down to 1.4 per cent in 2023. In the short run, the recovery of the Finnish economy will essentially depend on the rate at which vaccines can be provided, the share of the population that gets vaccinated, and the extent to which the current and future vaccines provide protection against new variants of the virus.

The world economy will experience a strong upswing this year, but in many countries growth will be stronger next year. Massive fiscal stimulus and rapid progress in vaccinations boost the the U.S. economy already now and will help other countries as well. The euro area, however, is lagging behind in both vaccinations and fiscal stimulus, and restrictive measures are still being strengthened in many member countries, with the result that acceleration of growth will be delayed.

In Finland the negative impact of the COVID-19 pandemic on the labor market was not so dramatic as anticipated previously. Still, there are significant risks that might occur in 2021 as government withdraws policy support from the market participants (such as temporary changes on bankruptcy law). We expect the unemployment rate to be 7.4 per cent in 2021 if economy starts to normalize in early June. We forecast that unemployment returns to pre-Covid level in late 2022 or early 2023.

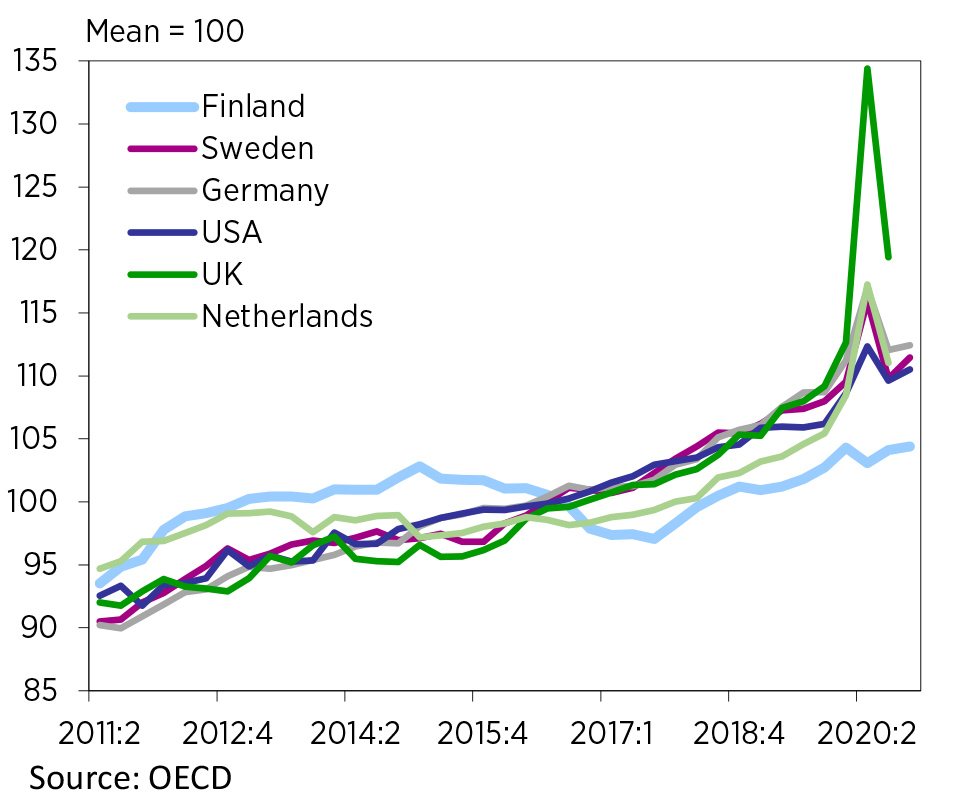

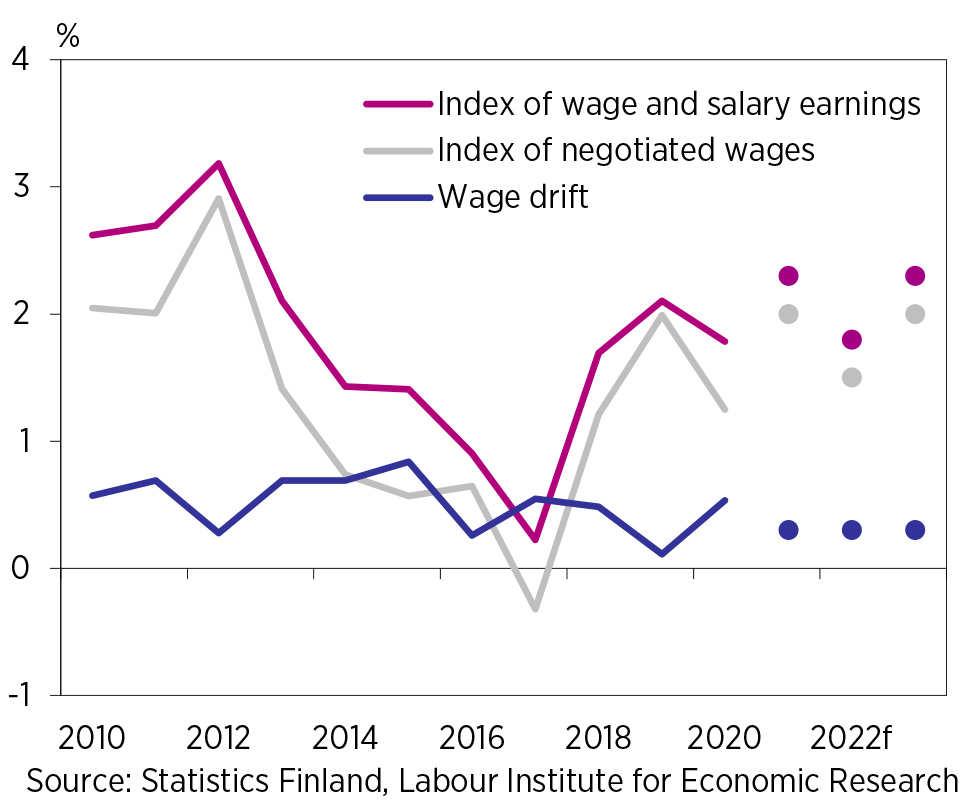

Unlike the finance crisis of 2009, the current crisis has not reduced the cost competitiveness of Finland, when measured by the nominal unit labor costs of the economy. There are nevertheless reasons for moderation in wage increases, since during the crisis the em-ployers’ earnings-related pension insurance contributions were reduced, a regulation which will no longer be valid in 2022.

Last year the decline in foreign trade was in Finland smaller than expected: both exports and imports were reduced only by 6.6 per cent. The decline in foreign trade was largely caused by a reduction in the exports of services and, more specifically, by the collapse of the trade of transport and travel services. The growth rate of exports will largely be determined by the timing of the return to a more normal level of exports of trans-port and travel services. Soft indicators suggest that there will also be a moderate upswing in the exports of goods.

DEMAND AND SUPPLY

Investments are forecasted to start to recover from the corona crisis and to grow this year. The growth of construction investments is subject to an exceptionally large amount of uncertainty, but they are forecas-ted to increase. Also investments in machinery and in intellectual property products are forecasted to grow. Overall, investments are forecasted to increase by 2.0 percent this year. Next year investments are forecasted to grow 3.2 percent. In 2023 investments shall grow 1.6 percent.

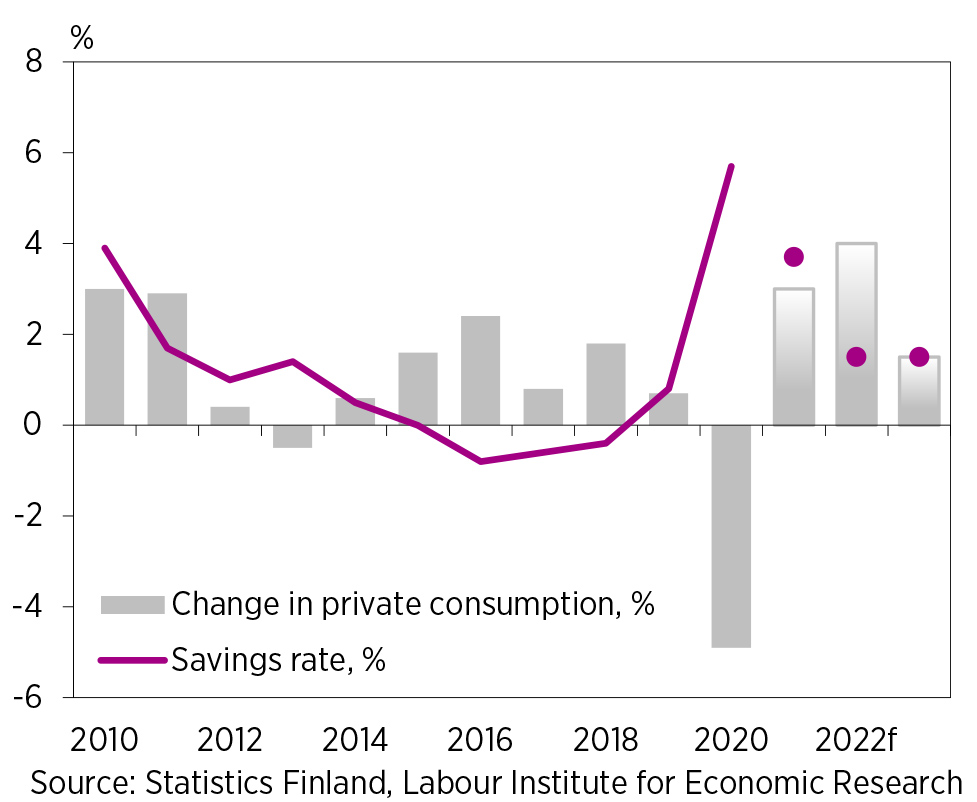

After a substantial fall in private consumption and surge in household savings in 2020, private consumption is forecasted to growth strongly in the current and coming years. Consumption growth is forecasted to be strongest in services and semi-durable goods, which were affected by the crises the most. Private consumption growth is tied to the overall coronavirus situation and related restrictions. Consumer prices face upward pressures driven by the economic recovery and in-creasing consumption demand as well as rising energy prices. Consumption growth in years 2021–2023 is forecasted to be 3.0, 4.0 and 1.5 percent, respectively. Consumer price inflation in the same years is forecasted to be 1.3, 1.2 and 1.1 percent.

After the huge fiscal expansion in 2020, the in-crease in public debt will be restricted by the spending limits procedure of the central government. The most important aim of the central government’s fiscal policy will be the reduction of the sustainability gap. Never-theless, the EDP debt will increase dramatically also in 2021-23. The health and social services reform will be implemented in 2023, and a considerable part of the tasks of the local governments will be allocated to the new wellbeing services counties. This will lead to a dramatic reduction of the spending of local govern-ments, and a corresponding increase in central govern-ment spending.

The effects of the Recovery and Resilience Facility of the EU will be procyclical since its funds will mostly be used during the upswing after the crisis. The use of fiscal stimuli for boosting the economy will no longer be justified when its funding is used, although there might be other justifications for the facility, such as the support for digital transformation and the green transition that it provides.

NOMINAL UNIT LABOUR COSTS OF THE WHOLE ECONOMY 2011:2–2020:4

INDEX OF WAGE AND SALARY EARNINGS AND INDEX OF NEGOTIATED WAGES 2010–2023

PRIVATE CONSUMPTION AND SAVINGS RATE 2010–2023

- Ilkka Kiema

- Research Leader

- Tel. +358-40 940 2287

- ilkka.kiema@labore.fi

- Profile