Bumpy Road Ahead – Recovery Amid Uncertainty

Economic Forecast 2025–2027

- The economic outlook remains dominated by uncertainty.

- Finland’s recovery hinges on avoiding major new trade barriers.

- Strong exports to Europe and a well-functioning EU internal market are vital for sustained growth.

- Investment is expected to rebound over the forecast period, supported by looser monetary policy and a gradual revival in construction.

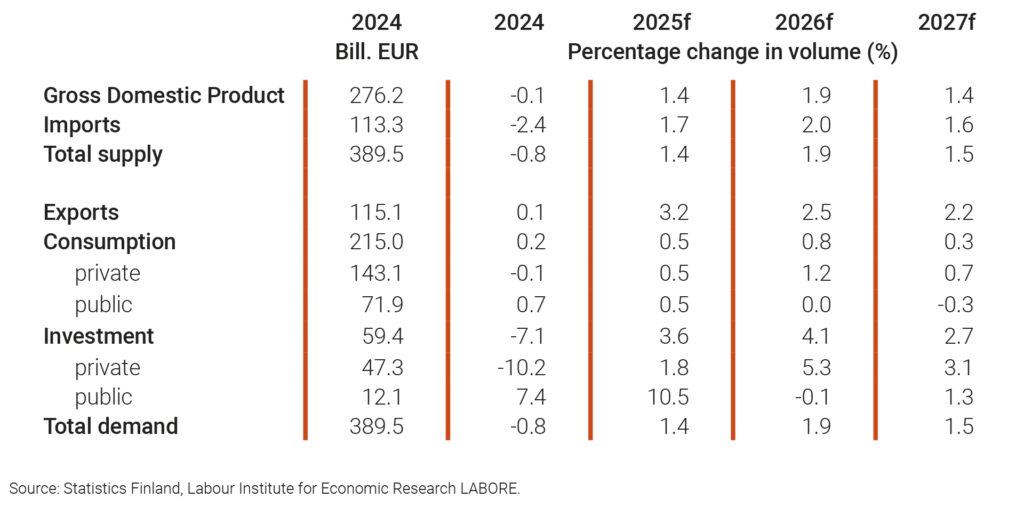

According to preliminary figures from Statistics Finland, Finland’s gross domestic product (GDP) contracted by 0.1% in 2024, following a 0.9% decline in 2023. While net exports and public consumption supported growth last year, private consumption was flat, and investment fell to roughly the same level as a decade ago. We expect investment to improve gradually, aided by looser monetary policy and public measures such as increased defense spending and investments in research and development.

Demand and supply

Overall, the economy stagnated in 2024, and the 2025 outlook remains uncertain. Trade barriers and geopolitical tensions are weighing on growth prospects, as both investment and household consumption are sensitive to uncertainty. Nonetheless, we forecast GDP growth of 1.4% in 2025, 1.9% in 2026, and 1.4% in 2027.

Our projection rests on three key assumptions:

- No escalation of major trade conflicts. We assume significant new trade barriers will be avoided. For example, while recent U.S. policy introduced 25% tariffs on certain imported cars and parts, we expect negative effects on the dollar, inflation, and stock market to limit further escalation. Germany’s substantial fiscal stimulus should also offset some of the impact in Europe.

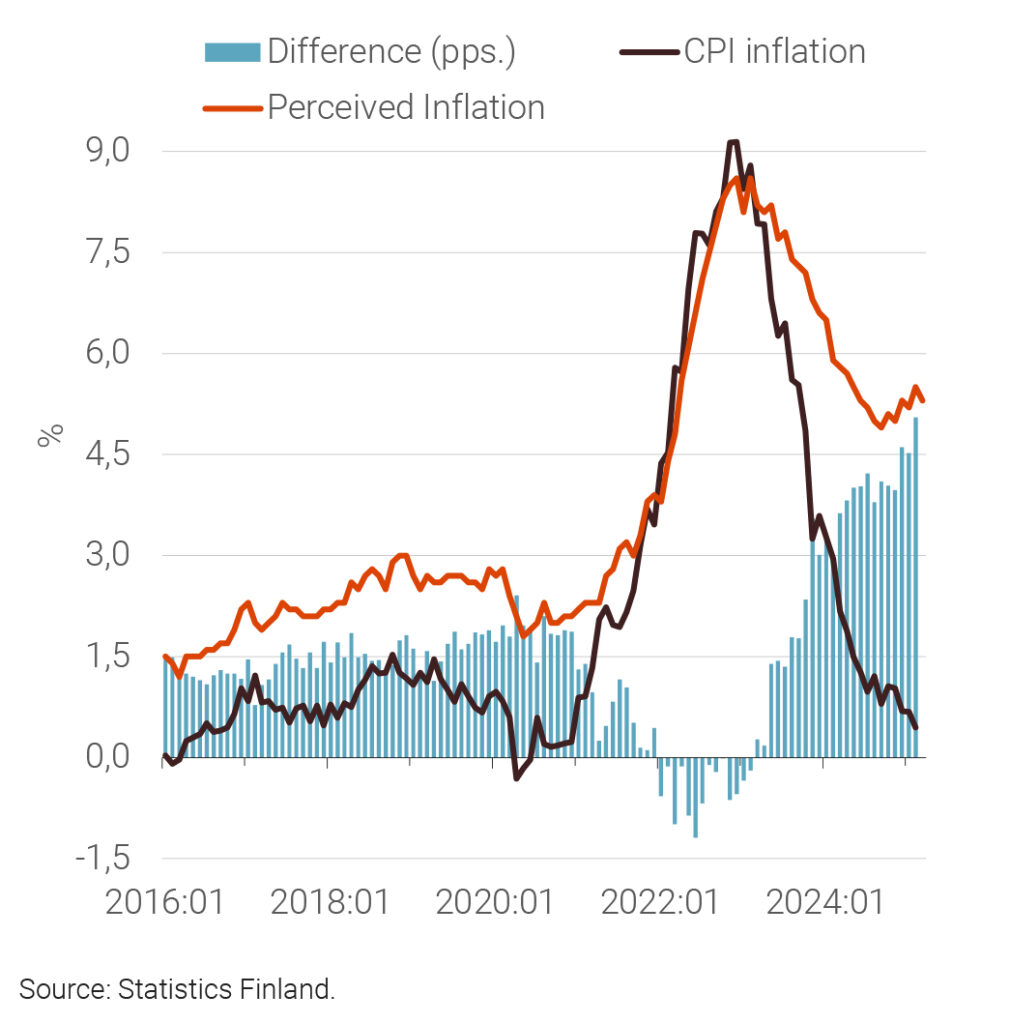

- Recovery in household consumption. As inflation stabilizes near 2% and monetary policy shifts from restrictive to neutral, consumer spending should recover. Although consumer confidence surveys show households still perceive inflation as high, we expect this perception to ease in 2025, reducing uncertainty and supporting demand.

- Gradual rebound in construction investment. After two years of sharp declines, housing transactions and mortgage lending are beginning to rise, even as prices continue to fall. This mixed picture suggests a slow recovery. Construction investment subtracted about 1.5 percentage points from GDP growth in 2023 and 1 point in 2024, making it a major driver of recent weakness.

Outlook for the Coming Years

The global economy is clouded by uncertainty, with U.S. trade policy weighing on the outlook for international trade. Current measures focus on import tariffs, though their final scope remains unclear. Meanwhile, Washington’s growing distance from traditional allies has prompted Europe to boost defense spending, increasingly sourcing production locally. In China, structural challenges persist, including weak private demand and a troubled real estate sector. The central government is seeking to offset short-term weakness through fiscal stimulus.

In Finland, unemployment stood at 9.2% in the latest Statistics Finland data — around three percentage points above the euro area and EU averages. We expect unemployment to ease this year but remain just above 8% over the forecast period. Employment has held up better, staying close to pre-pandemic levels at roughly 76.5%. Stabilizing private-sector employment offers optimism, but weak labor demand will limit short-term gains despite government efforts to expand the labor force.

Goods exports fell about 4% in 2024, partly due to port strikes early in the year. However, a 10% surge in service exports offset the decline, keeping total exports at 2023 levels. Goods imports fell for the second year in a row, reflecting weak demand and inventory reduction, bringing total imports down to 2.4%. Consequently, net exports contributed positively to GDP growth. For 2025, we forecast exports to rise by 3.5%, helped by a major ship delivery, and by just over 2% in 2026 and 2027. Imports will return to growth as the economy strengthens, increasing by roughly 2% annually, with fighter jet deliveries boosting figures.

Inflation has slowed steadily this year. In February, the annual change in the consumer price index (CPI) was 0.5%, down from 3.0% a year earlier, largely due to lower mortgage costs following ECB interest rate cuts. Harmonized CPI inflation, which excludes mortgage costs, stood at 1.5%. Tax changes, including a higher VAT rate from September 2024, will raise inflation to an average of 1.3% in 2025 before it stabilizes near 2% in 2026–2027.

Investment is expected to recover during the forecast period, driven by a gradual rebound in residential construction, increased defense spending, and growth in R&D supported by public funding and private-sector tax incentives. We project investment growth of 3.6% in 2025, 4.1% in 2026, and 2.7% in 2027.

Public sector debt will rise sharply early in the forecast horizon before stabilizing at around 85% of GDP by the end of the period. While government fiscal adjustments will increasingly take effect from 2025, revenue growth will remain constrained by sluggish tax receipts. At the same time, higher net interest payments and defense spending will continue to add pressure to public finances.

Figure 1. CPI inflation and perceived inflation 2016:01–2025:03

Figure 2. Trend indicator of output and quarterly GDP 2016:01–2025:02

- Juho Koistinen

- Head of Forecasting

- Tel. +358-40 940 2833

- juho.koistinen@labore.fi

- Profile